10 Wasteful Things That Frugal People Do

/Despite the best of intentions, frugal people can sometimes make decisions that are less-than-ideal from a long-term financial perspective… like these 10 wasteful things that frugal people do.

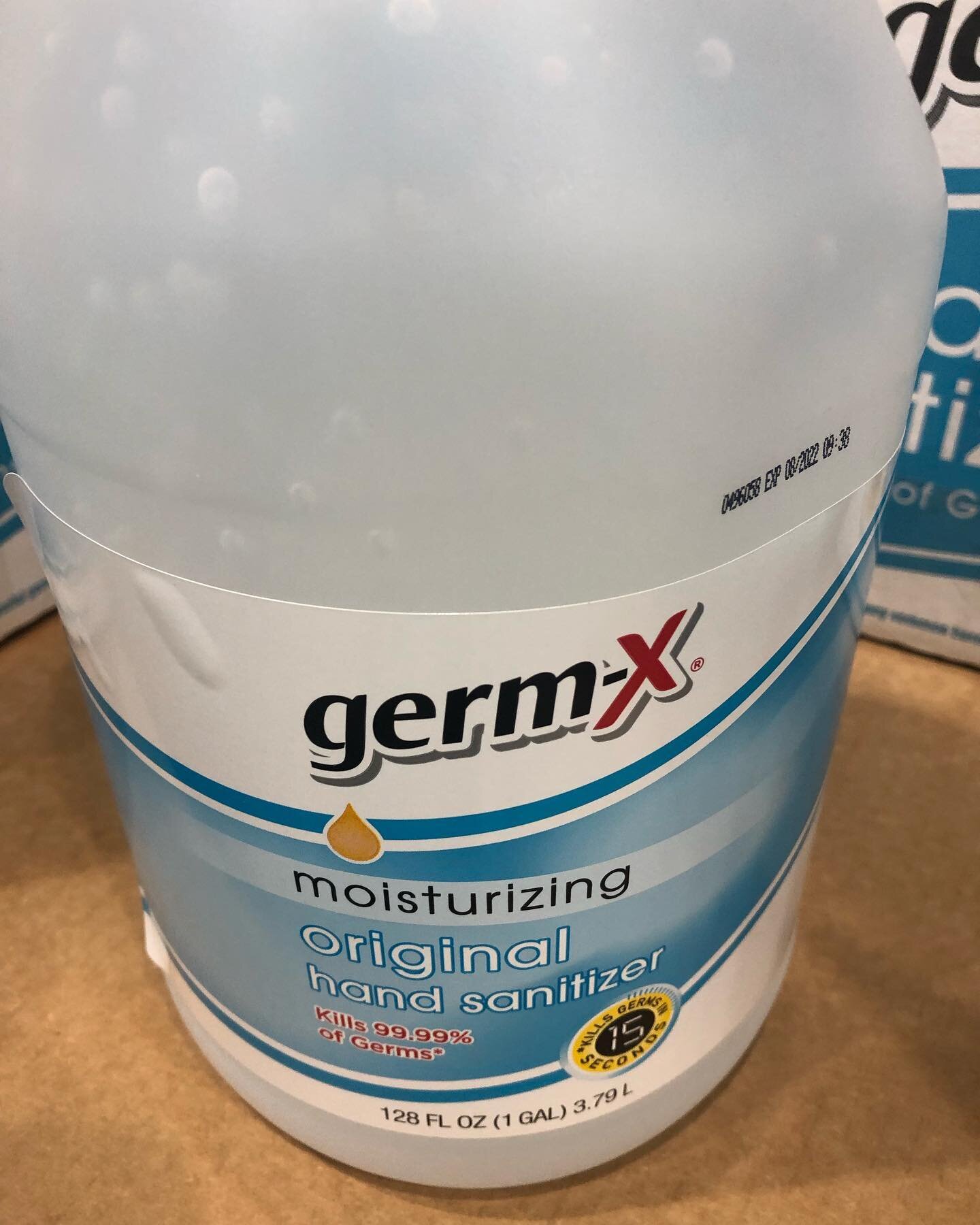

1. Buy in Bulk Blindly

There is no doubt you can save money over time if you buy certain items in large quantities. Common products that you use on a regular basis, such as toilet paper or cooking oil, are great candidates for bulk buying. But you need to be very careful when buying perishable food items, because anything you don't consume quickly may end up in the trash — and that's a waste. Also, it's best to avoid buying anything in bulk unless you're sure you like the product. Buying 10 boxes of laundry detergent is fine, but what if you find after the first load that it doesn't clean your clothes very well?

(Yes, I have done this!)

2. Use Coupons Unwisely

If you're frugal, it's a rush to hold that little piece of paper that allows you to buy something for 20% off. Before you go shopping, however, it's best reflect on whether it's a product you planned to purchase anyway. Remember that coupons exist solely to entice consumers to buy certain products. If you're spending money that you wouldn't otherwise spend — even if it's on a deeply discounted product — you're not saving money. The only real way to save money is to not spend it.

3. Delay Repairs

Sometimes, spending a little bit of money now can save you from a major bill down the road. If you are super-frugal you may be tempted to ignore that missing shingle on your roof or that leaky faucet. You may delay oil changes and other scheduled maintenance on your car. Though you may save money in the short term, you may end up paying more in the end when you face a massive repair on your home or car.

(Sometimes, yes!)

4. Fail to Seek Quality

The frugal person inside you never wants to spend more than you have to, but that doesn't mean you should always go after the product with the lowest price. Often, the cheapest bicycle in the store is inexpensive because it's made with lower-quality materials, and that could mean it won't hold up on that week-long mountain biking trek you have planned. If you truly want to save money, search for products that offer the best combination of quality and price. You may be better off financially if you spend more money for a product with a long lifespan than a poorly made product that will leave you disappointed.

5. Eat Badly

Eating well can sometimes be a challenge from a financial standpoint. You may feel it's cheaper to buy a couple of McDonald's cheeseburgers than to make a fresh fruit smoothie and a salad. When you don't eat well, you're putting yourself at risk for conditions such as obesity, diabetes, and heart disease. So in the long run, whatever money you save by eating junk simply goes to medical bills.

The good news is that eating well can be inexpensive if you know how to go about it. Drink water instead of sugary drinks. Rely on low-cost fruits and veggies like bananas, tomatoes and cucumbers. For breakfast, enjoy a big bowl of oatmeal with raisins. You can eat healthy and save money, if you try.

6. Keep Too Much Cash in Savings

This seems counterintuitive, but ultra-frugal people can sometimes be ultra-conservative when it comes to investing, preferring to keep more money than they need in low-interest savings accounts. By doing this, they may have peace of mind, but actually are costing themselves thousands of dollars in possible financial gains.

It's definitely essential to have an emergency fund, but few financial advisors would advise keeping anything more than a year's worth of living expenses in cash accounts. Be honest with yourself about how much liquid savings you really need, and invest any extra cash in index funds.

7. Skimp on Insurance

You may be young and in shape, and don't feel the need to spend too much on health insurance. Or you may feel like it's not worth it to spend a lot of money on auto insurance because you never get into car accidents. It's okay to shop around for the best rates, but there is a danger in being under-insured. Even after the passage of the Affordable Care Act, which caps the amount people must pay for treatments, patients can be on the hook for thousands of dollars. And if you spend too little on auto or homeowner's insurance, you may find that some things aren't covered under your policies. In the long run, too little insurance could result in higher costs for you.

8. Refuse to Take a Vacation

Many frugal people look at travel as an extravagance. There's no doubt that taking a trip can be expensive, but when you absolutely refuse to take time off of work, you're wasting vacation days. And there is a growing body of evidence that suggests doing that is bad for you and for your employer.

9. Save Too Much Stuff

You save everything, because you can't bear the thought of throwing something away that still has value. Those old video games. Your record collection. All those crates of kids' clothes. You feel like you might need these things at some point, so you keep them around. But in the long run, are you really saving money? After all, all that stuff might require a bigger house, and maybe even a storage unit with a monthly payment. Real frugality should be about simplifying your life, not holding onto your old stuff.

(Yes, I tend to save things! But lately I have been decluttering)

10. Turn Your Home's Air Conditioning or Heat On and Off

It's logical to think that you should turn off the heat or air conditioning if you're not going to be home. But the reality is that turning your thermostat off and then turning it on when you get home actually uses up more energy. The best way to save money is to have a programmable thermostat that allows you to vary the temperature throughout the day without turning the heat or air conditioning off.

Source: Wisebread.com